- Blog

- Why outsourcing should be part of any crisis management strategy

Why outsourcing should be part of any crisis management strategy

The natural disaster is yet another reminder that nothing is ever certain in business. From the fiscal turmoil of the Global Financial Crisis and lockdowns of the COVID-19 pandemic to the Icelandic volcano eruption that closed European skies in 2010, excepting the unexpected is a fact of business life and a key reason crisis management should be part of any corporate strategy. This is reinforced by a PwC study that found 69% of business leaders say their companies experienced at least one crisis over a period of five years, with the average number of crises being three4.

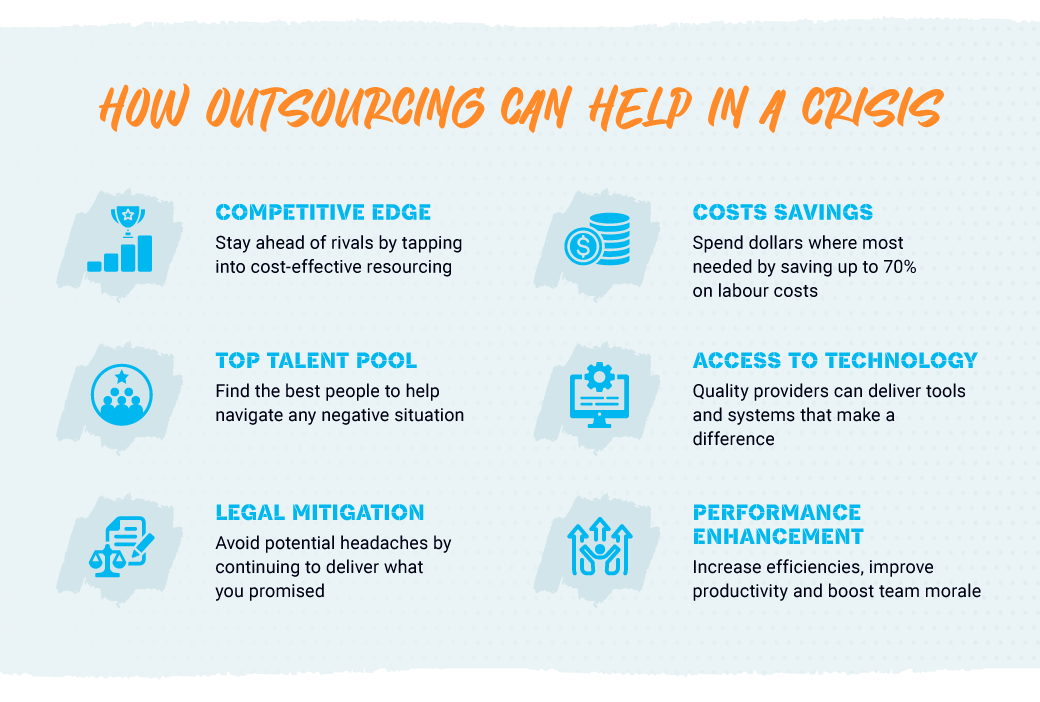

Successful organisations are those that have plans in place to navigate hurdles that appear in the form of global events, industry-wide challenges or internal issues. With speculation of economic hardship on the horizon and even talk of a looming recession, it has never been more important for executives and managers to put plans in place to navigate difficult times and outsourcing should be part of any such crisis management strategy.

Outsourcing in a crisis - industry examples

Outsourcing is routine for many businesses, with the ability to hand certain tasks to onshore or offshore employees helping increase efficiencies, reduce costs and improve customer experience. Then there are those organisations that leverage existing partnerships or form new ones to ensure they stay afloat in tumultuous business environments.

- Healthcare – hospitals and healthcare providers have long been under strain. An ageing and less active population means demand is increasing at the same time budgets are getting tighter. The global pandemic was an extreme example but it only takes a particularly bad flu season or local epidemic to stretch services to their limit. Outsourcing repetitive and time-consuming tasks such as administration, data services, contact centres and medical billing and transcribing eases the burden on in-house staff and allows them to focus on more valuable tasks.

- Banking and finance – with inflation on the up and mortgage stress tipped to soar on the back of interest rate rises, many banks are bracing for a wave of customer enquiries. Rather than rely on the status quo, outsourced contact centres boast quality agents and cutting-edge technology to manage an influx of calls while lowering average handling times and costs. Back-office support is also available to reduce the risk of mistakes in a sector where simple errors can be very costly, while outsourcing credit and collections means the likes of hardship enquiries and debt pause requests can be managed with the care they deserve.

- Travel – few industries are more beholden to external pressures than travel, with everything from volcanic eruptions and poor weather to political instability capable of putting a halt on their customers’ best-laid plans. Furthermore, let’s not forget a little thing called COVID-19. When such pressures peak, outsourcing allows travel operators the luxury of scaling up their workforce resources to tackle huge contact centre volumes, manage booking demand or ease the strain on overworked staff.

These are just a few examples of how outsourcing can ease the burden of a crisis across a handful of industries. From automotive and telecommunications to retail and eCommerce, there are countless other sectors that appreciate the value of having somewhere to turn for support when hard times hit.

Summary

Navigating a crisis typically requires businesses to go above and beyond their normal duties and while many team members will step up, outsourcing is an attractive and cost-effective way to manage overflow. By scaling physical support when unforeseen events strike or implementing effective overflow technology to maintain functionality, organisations ensure their customers receive the service they deserve and their staff are not overwhelmed. In both cases, this builds loyalty and ultimately results in long-term success.

Business uncertainty has become a way of life during the past few years but such challenges can be eased and even overcome. Discover six tips for rising above economic uncertainty and how to get in front of a crisis rather than wait for it to arrive.

References:

[1] New Zealand – 20,000 Insurance Claims Made After Auckland Floods – FloodList

[2] Gabrielle and Auckland floods to erode profits of NZ property insurers | Insurance Business New Zealand (insurancebusinessmag.com)

[3] Auckland floods: city begins clean-up after ‘biggest climate event’ in New Zealand’s history | Auckland | The Guardian

[4] Global Crisis Survey 2021: PwC

-3.jpg)